CTRM as a Service

CTRMCloud™ offers “CTRM as a service” as a modern easily deployed subscription service to help organizations across the commodity value-chain with real time decision support & intraday reporting.

CTRMCloud™delivers the benefits of a modern, cloud-native solution including rapid implementations, continuous product enhancements, high performance, scalability, better user experience.

Trading

CTRMCloud™ allows for the easy and intuitive capture of trading data, and supports opportunity-spotting business analytics and reporting across multiple commodities and geographies.

The platform provides comprehensive management of exchange traded, over-the-counter (OTC), foreign exchange (FX), and interest rate (IR) derivatives as well as physical transactions.

CTRMCloud™ supports standard connectors to major exchanges for fully automated trade connectivity in real-time.

For manual trade entry, CTRMCloud™ intuitive deal entry is quick and pain free. CTRMCloud™ improves efficiencies in trade capture through deal entry templates and blotters coupled with the ability to upload from spreadsheets.

Risk Management

Comprehensive risk management solution to control and mitigates price, operational, and regulatory risk.

CTRMCloud™ provides real-time position and coverage visibility across physicals and derivatives, identifying exposures and enabling timely decisions and actions. Companies can capture, analyse, manage, and report transactions in real-time, giving a complete transparent view of physical and financial mark-to-market P&L.

The solution provides sophisticated analytical and visualization tools to support scenario optimization, including:

-

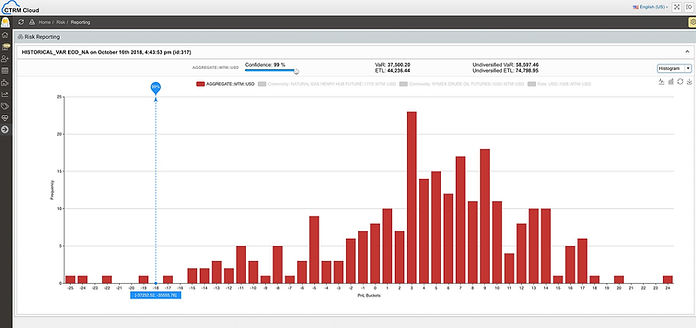

VaR – Flexible, multi-dimensional simulations showing exposures to commodities, FX and other market factors.

-

Simulation Manager – Understand the impact that changes to price, volatility, time and interest rate curves have on Position, Greeks and MTM P/L.

-

What-if Trades- Enter trades and see results before deciding whether to abort or execute.

.

Front Office

• Deal Capture

• Template-Based Deal Entry

• User-Defined or Pre-Populated Fields for Deal Creation

• Hourly and Sub-Hourly load/demand and generation forecast data

• Deal Valuation

• Price Curve Management

• Price Curve Management – Hourly and Sub-Hourly Granularity

Middle Office

• Analyze Value-at-Risk (VaR) of Multiple Portfolios

• Stress-test multiple risk scenarios in real time

• Powerful, easy-to-use scenario analysis allowing users to gain insight into various elements of risk exposure

• Flexible, multi-dimensional simulations showing exposures to commodities, FX and other market factors

• Support for Flat or Shaped shocks

Back Office

Comprehensive settlement and accounting functionalities

API Support for Integration into back office systems Integration and Connectivity:

• CME

• ICE

• Nodal Exchange

Market Data

• Morningstar

• Reuters

• CME EOD Settlement

"CTRMCloud™ offers immediate value. We were able get all our trades into the system, have a complete view of our positions, mark-to-market, P&L and risk within the first week of starting to use the system."

Doug Condon, Managing Director, Three Rivers